Car Loan Approval: What It Is and How to Get One

March 20, 2023If you're in the market for a new car, getting a car loan approval beforehand can make the car buying process much smoother. A car loan approval, also known as a pre-approval, is when a lender provides you with an estimate of how much money they are willing to lend you to buy a car.

By obtaining a car loan approval, you'll have a better idea of what your budget is and can shop for cars accordingly. Additionally, having a car loan approval can help you negotiate a better price for the vehicle you want to buy. It also never hurts to start planning for a vehicle purchase early.

So, how do you go about getting a car loan approval? Here are some steps you can take:

1. Check Your Credit Score

Your credit score is a major factor in determining whether or not you'll be approved for a car loan. Before applying for a car loan approval, it's a good idea to check your credit score and make sure it's in good standing. A higher credit score will usually lead to a better interest rate and more favorable loan terms. We talk more about rebuilding your credit here.

If you have a high-interest loan, check your credit score regularly as you pay it back. As it improves, you may become eligible for lower-interest loans. Talk to your bank about refinancing – a new loan to pay off the higher-interest loan. (We also offer debt consolidation as an add-on to some auto financing options). You will probably be charged a fee for early payout, but it’s likely the new loan may still cost less in the long run with its lower rates.

|

|

|

|

300 – 599Your credit is poor and needs some work. |

600 – 649This is fair credit. |

650 – 719This is considered good to lenders. |

720 – 900You have very good credit! |

2. Be realistic about the vehicle you want

If you don't have great credit, your lender will want to minimize its risk. Asking for a lower amount improves your chances, so this isn’t the time to look at a premium model, a luxury SUV, or a full load of options.

That can come later as your financial profile grows. Of course, the purchase price is only the beginning, so be sure you can afford the monthly loan payment and the ongoing cost of car insurance, fuel and maintenance.

3. Research & Get Informed About Financial Lenders

There are many lenders that offer car loans, including banks, credit unions, and online lenders. It's a good idea to research several lenders and compare their rates and terms before applying for a car loan approval. This will help you find the lender that offers the best deal for your specific situation.

4. Gather Your Documents

When applying for a car loan approval, you'll need to provide some documentation to the lender. This typically includes proof of income, proof of residence, and proof of insurance. Gathering these documents beforehand can make the application process smoother.

You’ll likely need proof of employment, such as pay stubs. Make a list of addresses where you’ve lived in the past few years, and if you paid rent, include the receipts for it. Include copies of any bills you pay on a regular basis, such as phone or utilities.

Add anything that might be helpful, including your bank account statements. You’re establishing a pattern to show a lender that you have steady income and a history of making regular payments on your bills.

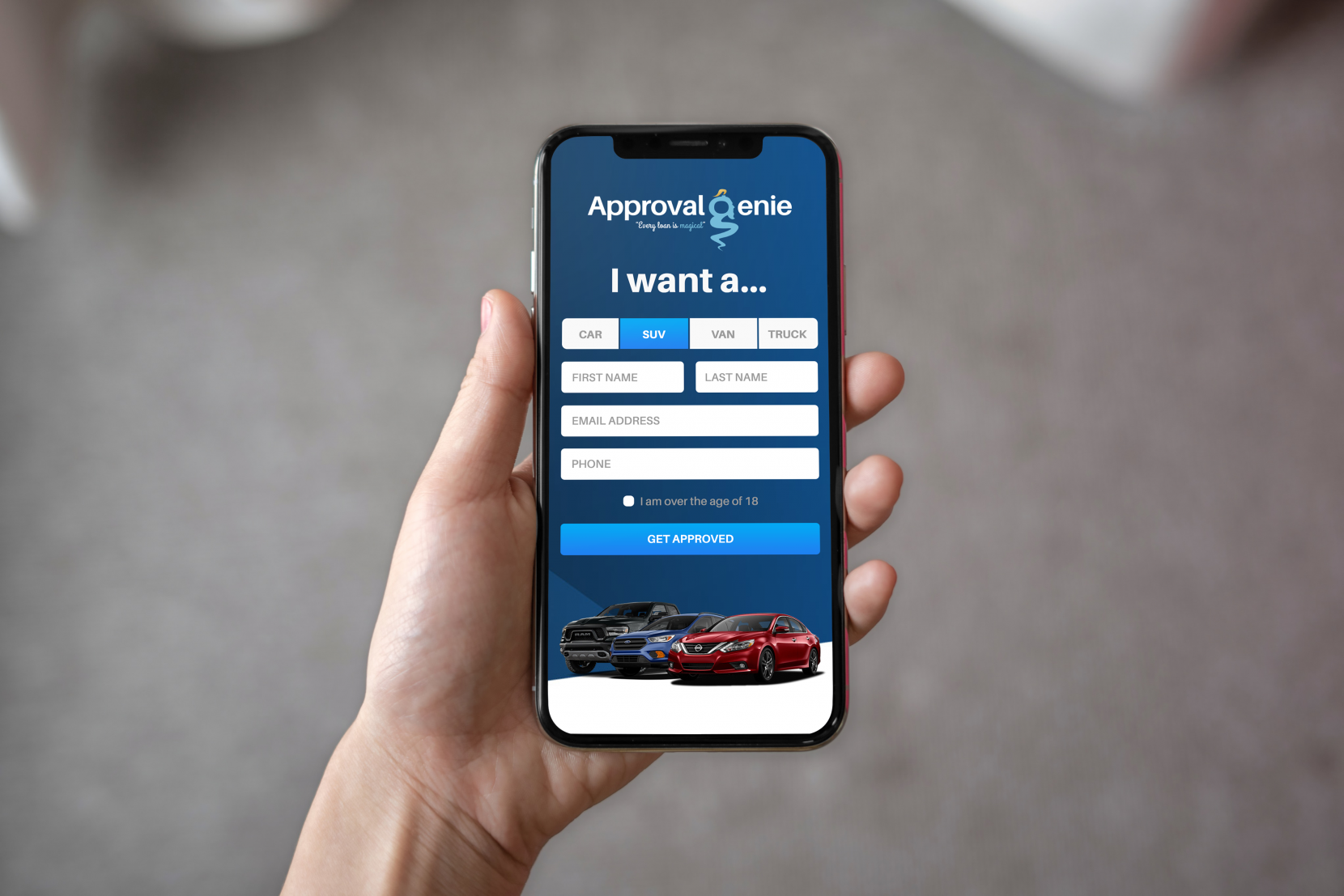

5. Apply for a Car Loan Approval

Once you've done your research and gathered your documents, it's time to apply for a car loan approval. You can typically do this online or in person. The lender will review your application and let you know how much money they are willing to lend you.

Obtaining a car loan approval can help you budget for a new car purchase and negotiate a better deal. By checking your credit score, researching lenders, gathering your documents, and applying for a car loan approval, you'll be on your way to driving your dream car.

It isn’t always easy to get a loan, but don’t give up. There are numerous options and one of them may be the opportunity for you.

JOIN THOUSANDS OF OTHER HAPPY CANADIANS