Master Your Car Loan with the 50/30/20 Rule

January 29, 2025Buying a car is a significant financial milestone. To ensure a smooth journey and avoid financial stress, a solid budgeting plan is essential. The 50/30/20 rule can be a valuable tool in managing your finances, especially when you're facing car loan payments.

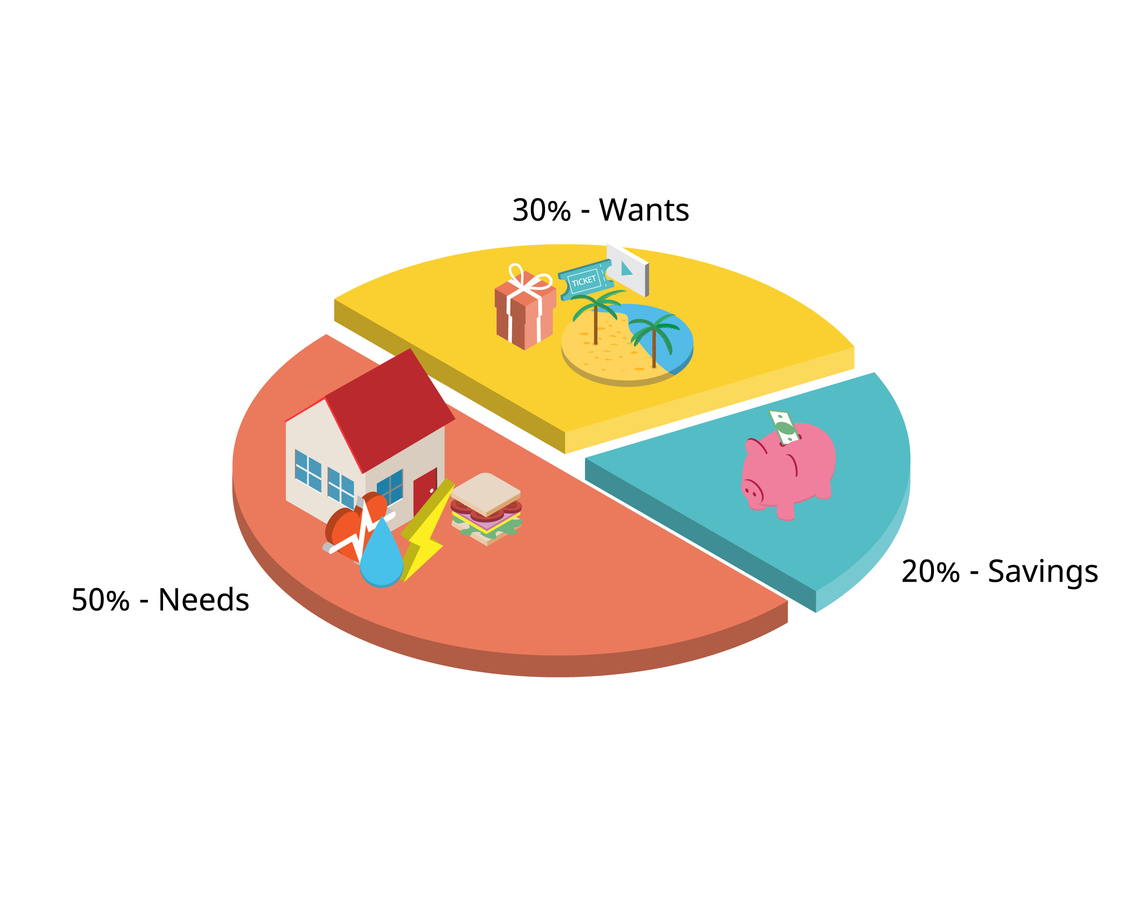

The 50/30/20 budgeting method suggests dividing your after-tax income into three categories:

- 50% for needs: This category covers essential expenses like rent/mortgage, utilities, groceries, transportation (including your car payment), insurance, healthcare, and other non-negotiable costs.

- 30% for wants: This category is for discretionary spending, such as dining out, entertainment, hobbies, shopping, and travel.

- 20% for savings and debt repayment: This is where your car loan payments will primarily reside. This category also includes savings for emergencies, retirement, and other financial goals.

Applying the 50/30/20 rule to your car loan:

- Calculate your net income: Determine your monthly income after taxes are deducted.

- Categorize expenses: Analyze your spending habits and meticulously categorize your expenses into needs, wants, and savings.

- Allocate your income: Allocate your income towards needs, wants, savings, and debt repayment.

- Factor in your car loan payment: Ensure your car loan payment fits comfortably within your 50% "needs" budget.

Tips for Making the 50/30/20 Rule Work for You:

- Track your spending: Monitor your spending closely using a budgeting app, spreadsheet, or notebook. This will help you identify areas where you can cut back and ensure you're staying within your budget.

- Automate savings: Set up automatic transfers to your savings account to ensure consistent contributions towards your financial goals.

- Reduce unnecessary expenses: Explore ways to reduce unnecessary spending, such as cutting back on dining out, finding cheaper entertainment options, or utilizing coupons and discounts.

- Explore ways to increase income: Consider side hustles or seeking a raise to increase your overall income and provide more financial flexibility.

- Review and adjust regularly: Regularly review your budget and make adjustments as needed. Life circumstances change, and your financial goals may evolve over time.

The 50/30/20 rule is a flexible framework. You can adjust the percentages to align with your specific financial goals. For example, if saving for a down payment on a home or paying down debt is a primary focus, you might allocate more than 20% of your income to savings and debt repayment, potentially reducing the amount allocated to "wants."

By following the 50/30/20 rule and making conscious financial decisions, you can successfully manage your car loan payments while achieving your financial goals. This framework provides a structured approach to budgeting that can help you stay on track and avoid financial stress.

FAQs

1. What is the 50/30/20 rule?

A budgeting method dividing income into Needs (50%), Wants (30%), and Savings & Debt (20%).

2. Can I adjust the percentages?

Yes, the 50/30/20 rule is flexible and can be adjusted based on your financial goals.

3. How do I implement the 50/30/20 rule?

Track spending, automate savings, and regularly review and adjust your budget.

4. What are the benefits?

Improved financial control, reduced stress, and a solid foundation for achieving financial goals.

5. Can I use the 50/30/20 rule if I have a high debt load?

Absolutely! The 50/30/20 rule can be particularly helpful when managing debt. Prioritize increasing the "Savings and Debt Repayment" percentage to pay down high-interest debt.

6. Is the 50/30/20 rule suitable for everyone?

The 50/30/20 rule provides a general framework. You may need to adjust it based on your individual circumstances, income level, and monetary goals.

JOIN THOUSANDS OF OTHER HAPPY CANADIANS