UNDERSTAND WHAT YOUR CREDIT SCORE REALLY MEANS

How To Improve Your Credit Score

More than ever before, good credit is a major contributor to financial well-being. Use these simple steps to improve your credit score.

What Is A Credit Score / Rating And Why It's Important To Improve Your Credit Score.

A Credit Score or Rating is a three-digit number between 300-900 that represents your credit risk.

Basically, a credit score is a mathematical formula that translates the data in the credit report into a three-digit number that lenders use to make credit decisions. A credit rating or score (also called a Beacon or a FICO score) is not part of a regular credit report. There are two different credit reporting bureaus in Canada, Equifax and Transunion. Each has its own approach to determining scores.

It's important to know where you stand on the credit score range. This can affect your ability to be approved for loans and credit products with lower interest rates and better chances of approval. Higher credit scores generally result in more favourable credit terms.

Lenders consider many factors, including your credit score and report, when assessing your creditworthiness. They may also help creditors decide what kind of risk you are and what interest rate you will be offered.

A credit score also represents the likelihood you will pay your bills on time. Ultimately, it's up to you to improve your credit score, which is why understanding your credit is crucial.

Keep reading for Approval Genie’s tips about how to improve your credit score.

PRO TIP: Use our quick and easy credit tool to check your credit score for FREE with what's known as a "soft check", that won't impact your credit:

What Is A Good Credit Score In Canada?

300 – 619

Is 600 A Good Credit Score?

Anything below 600, means your credit is poor and needs some work. Good news: Approval Genie can help! Keep reading for some improvement suggestions.

620 – 649

Is 620 A Good Credit Score?

This is fair credit. A history of debt repayment will be important to demonstrate your solid sense of financial responsibility.

650 – 759

Is 750 A Good Credit Score?

This is considered good to lenders. You may not qualify for the lowest interest rates available, but keep your credit history strong to help improve your credit health.

760 – 900

Is 800 A Good Credit Score?

You have very good credit! You should expect to have a variety of credit choices to choose from, so continue your healthy financial habits.

What does this rating on my credit score mean?

Explaining the numbers of your credit score.

The credit rating numbers go from 300 to 900. The higher the number, the better. For example, a number of 750 to 799 is shared by 27 per cent of the population. Statistics show that only two per cent of the borrowers in this category will default on a loan or go bankrupt in the next two years. That means that anyone with this score is very likely to get that loan or mortgage they’ve applied for.

So what exactly are the cutoff points? TransUnion says someone with a credit score below 650 may have trouble receiving new credit. Some mortgage lenders will want to see a minimum score of 680 to get the best interest rate.

The exact formula bureaus use to calculate credit scores is secret. Paying bills on time is clearly the key factor. But because lenders don’t make any money off you if you pay your bills in full each month, people who carry a balance month-to-month (but pay their minimum monthly balances on time) can be given a higher score than people who pay their amount due in full.

This isn’t too surprising when you realize that credit bureaus are primarily funded by banks, lenders, and businesses, not by consumers.¹

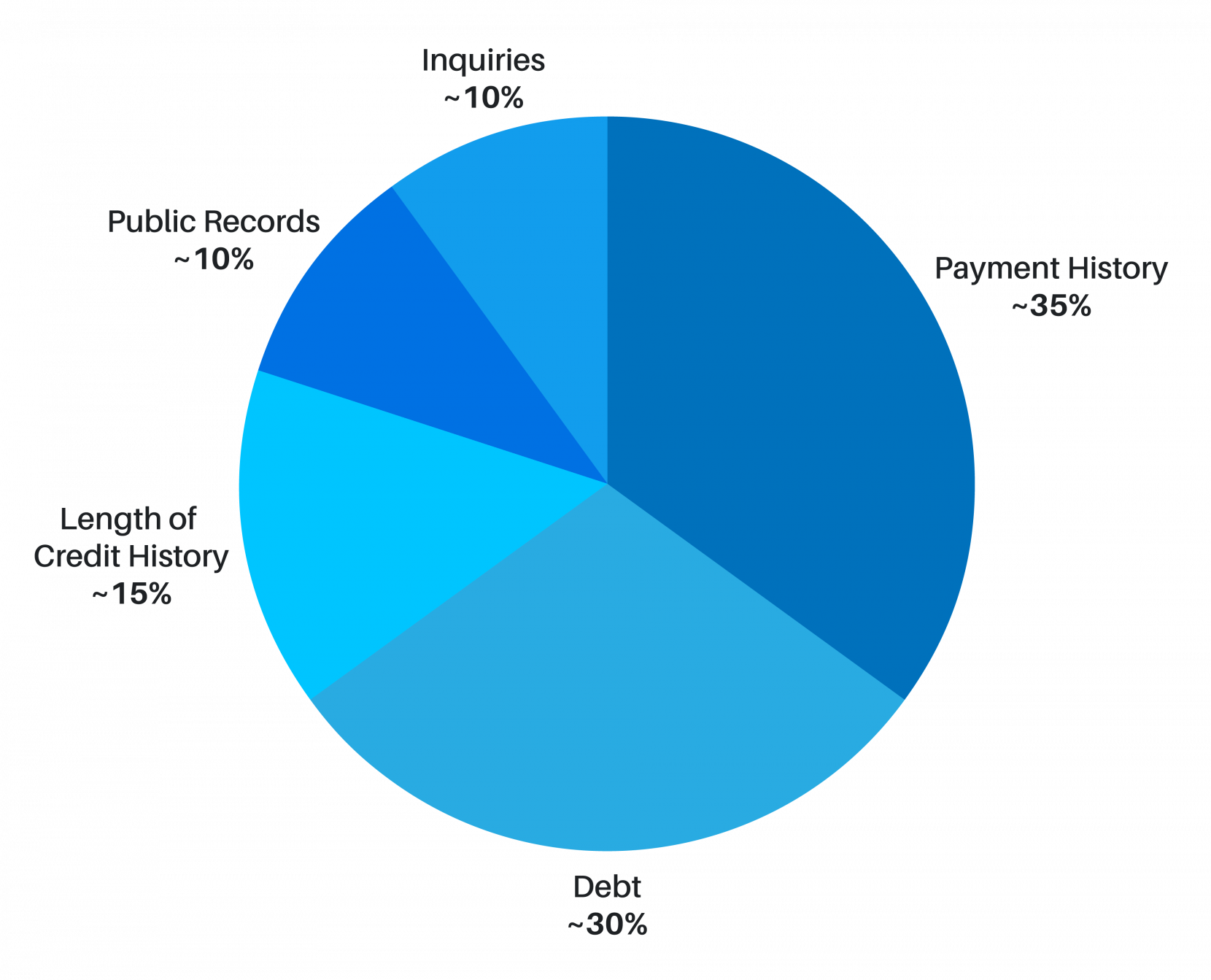

Factors That Can Affect The Calculation Of Your Credit Score

1. Payment History

A good record of on-time payments will help boost your credit score. Payment History accounts for approximately 35% of your Credit Score.

2. Outstanding Debt

Balances above 50 percent of your credit limits will harm your credit. Aim for balances under 35 percent. Outstanding Debt accounts for approximately 30% of your Credit Score.

3. Length Of Credit History & Public Records

An established credit history makes you a less risky borrower. Think twice before closing old accounts before a loan application. Length Of Credit History & Public Records account for approximately 25% of your Credit Score.

4. Recent Inquiries

When a lender or business checks your credit, it causes a hard inquiry to your credit file. Apply for new credit in moderation. Recent Credit Inquiries account for approximately 10% of your Credit Score.

How Long Does ‘Bad Credit’ Last?

Bad credit information or delinquent credit accounts — generally stays on your record for six to seven years.

However, the exact length of time is also dependent on the credit bureau. Equifax Canada counts from the date the debt is first assigned to a collection agency.

How Long Does It Take To Repair My Credit Score?

Conservatively speaking, you can expect improvement within months but it will take one to two years to materially correct most problems.

Too often, promises of full credit score recovery in 12 months are made, which is not realistic for most people.

Be wary of companies or individuals promising a “fast-track” return to good credit. Remember the old saying; allow us to paraphrase – “if it sounds too good to be true, it probably is!”

If I Have Gone Bankrupt In The Past, Can I Still Apply For An Auto Loan?

Absolutely! We encourage applying for a car loan if you have sub-prime credit.

You need a fresh start, and the team at Approval Genie is capable of providing just that. Discharged or not discharged, you have the opportunity to engage a path back to good credit status.

How Do I Improve My Credit Score?

The best way to improve your credit score after a mistake like a collection or a charge-off is to get some positive information on your credit report.

Here are some tips on how to improve your credit score:

If you still have active credit cards or loans, continue paying them on time. The same thing goes for accounts that aren’t reported to the credit bureaus.

Establishing a new “trade line” is essential when you have suffered from bad credit. Ironically, the only way you can start building your credit is by obtaining new forms of credit.

An automotive loan is one of the strongest forms of credit that can help you tremendously improve your credit score.

One preferred method of demonstrating good credit habits is with an approved auto loan from a reputable lender or financial institution.

Other proven methods of rebuilding or improving your credit rating and helping you improve your credit score:

1. Keep balances low on credit cards and other revolving credit: high outstanding debt can affect a credit score.

2. Don't go over your credit limit - if you have a credit card with a $5,000 limit, try not to go over that limit. Borrowing more than the authorized limit on a credit card can lower your credit score.

3. Get electronic alerts from your financial institution - your financial institution may send you an electronic alert when the credit available on your credit card falls below a certain amount. These alerts may help you manage your day-to-day finances, such as your credit payments.

4. Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving (credit cards) debt.

5. Have a mix of different credit products, such as a credit card, car loan and line of credit (just remember to keep the amount being borrowed to 35% or less)

6. Limit your number of credit applications or credit checks - When lenders and others ask a credit bureau for your credit report, it’s recorded as an inquiry. Inquiries are also known as credit checks. If there are too many credit checks in your credit report, lenders may think that you’re:

- urgently seeking credit

- trying to live beyond your means

7. Create a budget: once your more significant debts are paid, and you can soundly budget for the costs of owning a vehicle, consider an auto loan to improve your credit score.

What Is 'Second Chance Credit'?

Second chance credit is an industry term used to describe credit products being granted to those whose credit is bad.

If you have had a bankruptcy, consumer proposal or multiple payment defaults, this would most likely apply to you. Only specific lenders are set-up to work with those individuals who fall into this category as the risk of non-payment or default is perceived to be high due to past history.

Don’t worry though – we have a portfolio of second chance lender partners that we work with daily, so we are fully equipped to assist you if you fit into this category.

What Is The Best Way To Improve My Credit Score?

Here are a few proven ways to rebuild and improve your credit score:

1. Use your credit intelligently – don’t have more than 35% of your total available credit outstanding (i.e. if you have a credit card or line of credit with a $10,000 limit, don’t carry a balance of more than $3,500)

2. Manage your payments – always make your payments on-time, paying at least the minimum amount due

3. Keep credit accounts open and in use – the longer you have an account open, the better it is for your score, especially if you show a strong history of on-time payments. This way, even if you miss a few along the way, it doesn’t affect you as much

4. Don’t close everything – in most cases no credit is worse than bad credit as lenders are not able to gauge what you will do if they provide you a loan

If I Have A Good Credit Rating Should I Still Apply For A Car Loan?

Most definitely!

We have access to rates from different sources that differ in terms, amount to finance, vehicle models and year.

Our Advisors work with you to analyze and select the best rates tailored to your buying situation.

Contact Approval Genie today! We want to earn your business by saving you money.

How Do I Know That My Information Is Safe?

Approval Genie is a fully licensed Canadian credit approval company.

We have a strong history of banking with Canada’s largest financial institutions, which also requires us to maintain a strict relationship with the RCMP, including rigorous background checks.

As a result, Approval Genie pledges to uphold the highest standard of safety and privacy regarding the handling of your personal information.

Our business depends on it!

All of our advisors and used car dealerships in Mississauga, Airport Road, Whitby, Scarborough, Hamilton, Kingston, Ottawa and Laval are fully certified by OMVIC and the Quebec Consumer Protection Bureau (OPC).

Sources & Citations

Articles referenced for educational purposes:

¹https://www.cbc.ca/news/canada/how-to-check-your-credit-report-1.1185975

https://www.canada.ca/en/services/finance/debt.html

https://www.canada.ca/en/financial-consumer-agency/programs/financial-literacy.html

https://www.cpacanada.ca/en/the-cpa-profession/financial-literacy

http://www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/br01861.html

https://www.creditkarma.ca/credit/i/what-is-a-good-credit-score/

JOIN OVER HALF A MILLION OTHER HAPPY CANADIANS